In an increasingly complex and competitive global market, the agricultural commodities sector is facing significant challenges. The volatility of prices, uncertain weather patterns, and the need for sustainable production practices require innovative solutions to improve efficiency and optimize decision-making processes. One such solution is the integration of Artificial Intelligence (AI) in agri commodities trading. In this article, we will explore the concept of commodity AI, its role in the commodities market, AI techniques for trading, and how AI works in financial markets. We will also discuss how Helixtap, a leading technology firm, is helping agri commodities traders harness the power of AI, using rubber as an example.

What is commodity AI?

Commodity AI refers to the application of advanced AI algorithms and techniques in the analysis, forecasting, and trading of commodities. It involves using AI to analyze vast amounts of data from multiple sources, including weather, satellite imagery, historical price trends, and geopolitical developments. By processing and interpreting this data, AI can provide valuable insights to traders and help them make more informed decisions, ultimately leading to more efficient and profitable trading strategies.

What is the role of AI in the commodities market?

AI plays a significant role in the commodities market by enhancing the accuracy of forecasts and pricing models. With its ability to analyze large datasets and identify patterns, AI can help traders gain a better understanding of market dynamics and anticipate price fluctuations. This allows them to devise more effective trading strategies and manage risk more efficiently. Additionally, AI can help optimize the commodities supply chain by predicting demand and improving logistics, which leads to reduced waste and increased sustainability.

What are AI techniques for trading?

Some popular AI techniques used in trading include machine learning, natural language processing, and deep learning. Machine learning algorithms analyze historical data and patterns to predict future trends, while natural language processing helps interpret news articles, social media posts, and other textual sources to gauge market sentiment. Deep learning, a subset of machine learning, uses artificial neural networks to model complex relationships in the data, enhancing the accuracy of predictions and enabling more sophisticated trading strategies.

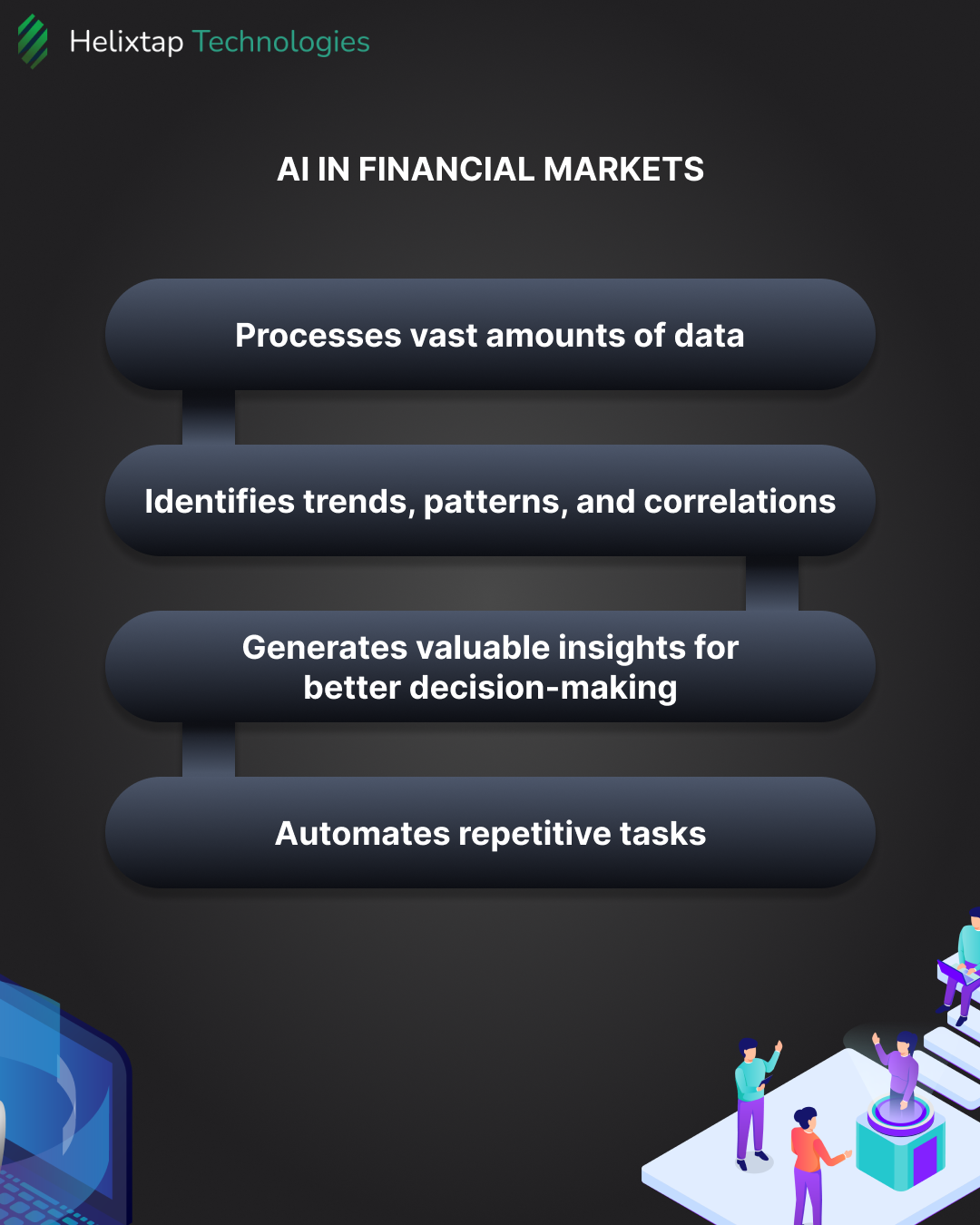

How does AI work in financial markets?

In financial markets, AI works by processing and analyzing vast amounts of data from various sources, such as market data, news articles, and social media posts. By identifying trends, patterns, and correlations in the data, AI can generate insights that help traders make better-informed decisions. AI-driven tools can also automate repetitive tasks, such as data collection and analysis, freeing up time for traders to focus on strategy development and execution.

How Helixtap helps agri commodities traders using AI with rubber as an example?

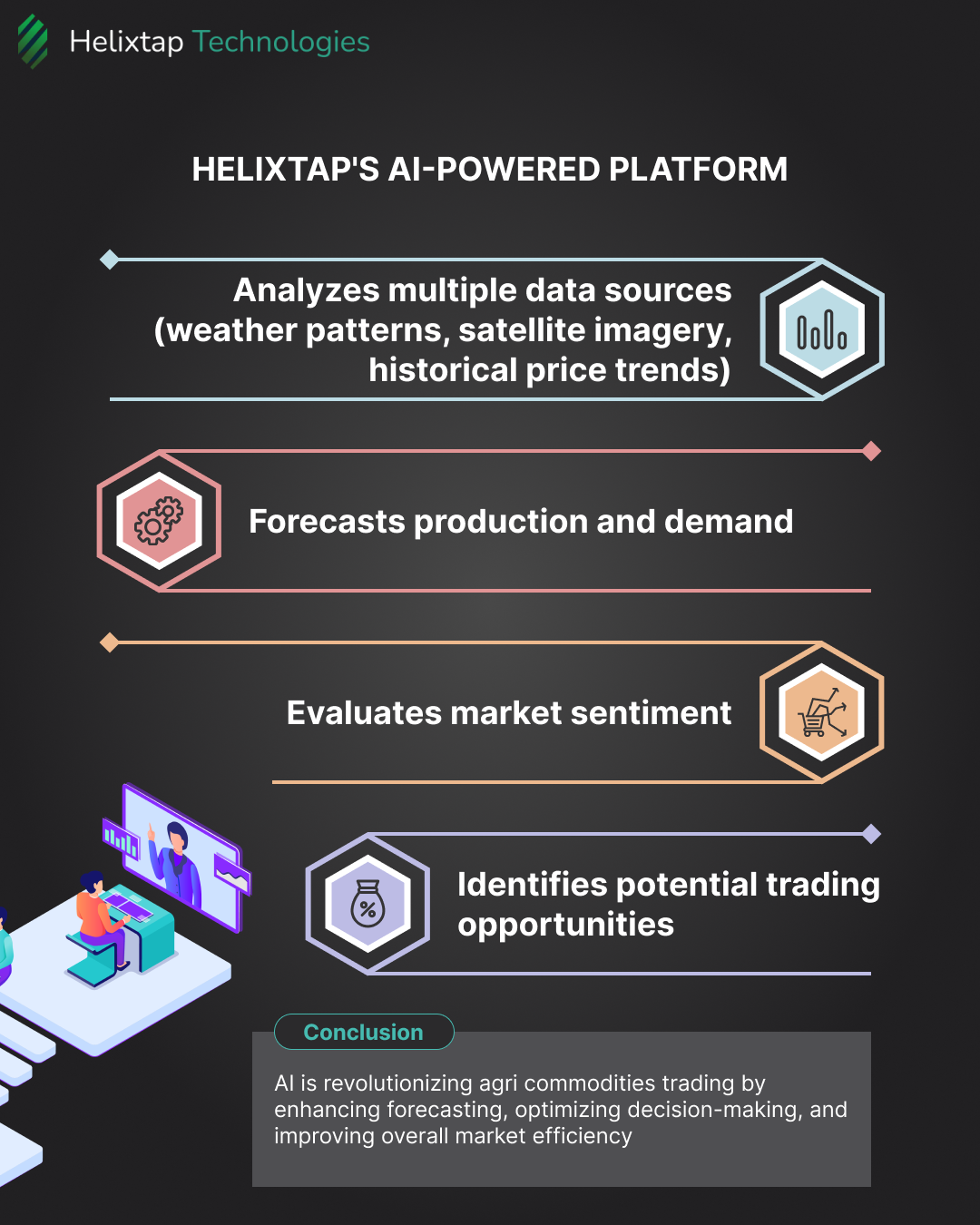

Helixtap is at the forefront of revolutionizing agri commodities trading by leveraging AI to provide valuable insights and improve decision-making processes. For instance, in the rubber market, Helixtap’s AI-powered platform can analyze multiple data sources, such as weather patterns, satellite imagery, and historical price trends, to forecast rubber production and demand. This helps traders better anticipate price fluctuations and manage risk more effectively.

Additionally, Helixtap’s platform employs advanced AI techniques like machine learning and natural language processing to evaluate market sentiment and identify potential trading opportunities. By offering a comprehensive and user-friendly platform that harnesses the power of AI, Helixtap enables agri commodities traders to make more informed decisions, optimize their trading strategies, and ultimately achieve greater success in the fast-paced commodities market.