As a key player in the rubber industry, Helixtap is committed to providing insightful and actionable data for tire manufacturers, automotive companies, and trading firms. With our cutting-edge machine learning capabilities and analytics, we help businesses navigate the complexities of the rubber market. In this article, we will explore the factors behind fluctuating rubber prices and how Helixtap data can assist in making informed decisions.

- Supply and Demand

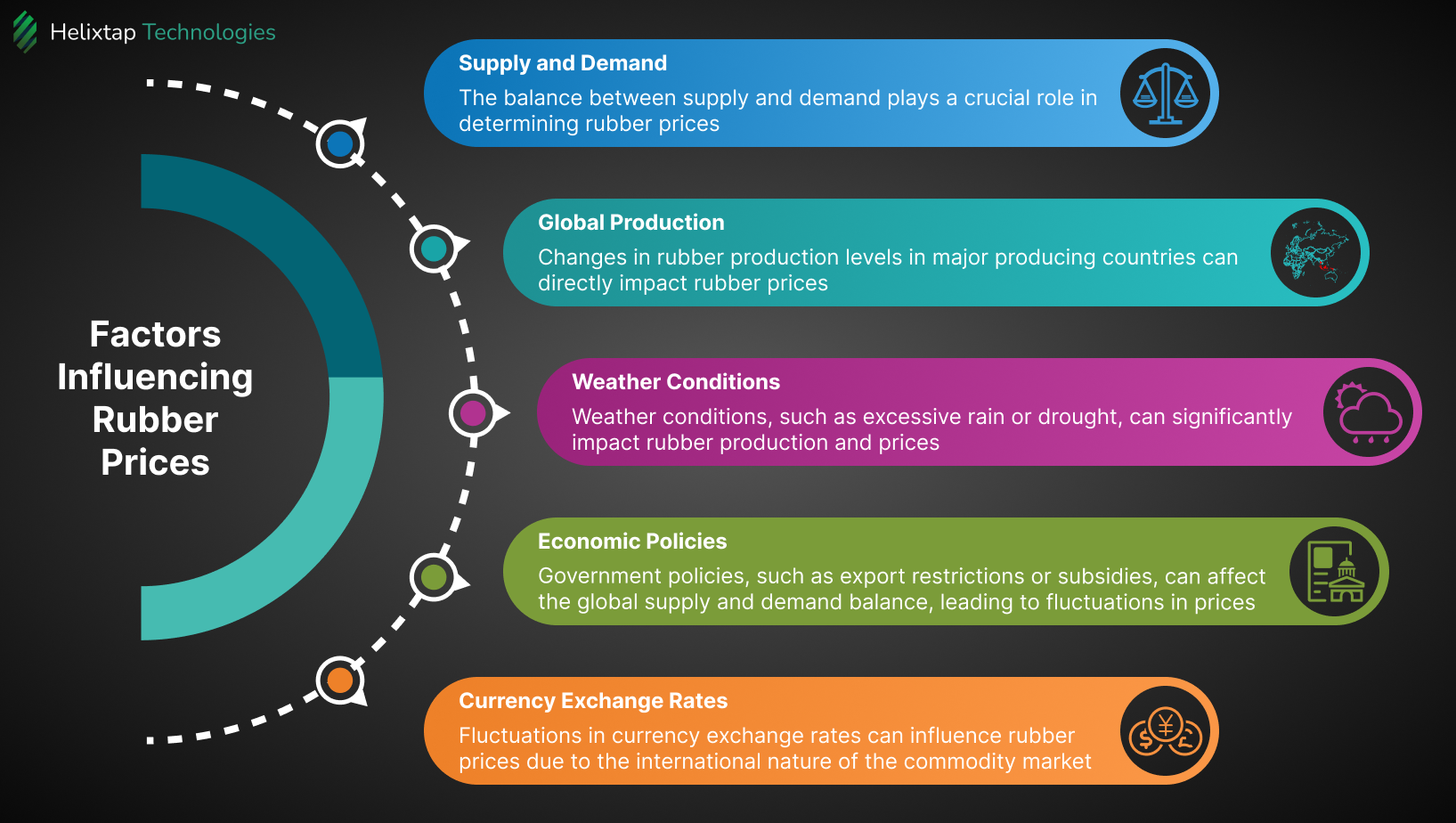

One of the most significant factors that influence rubber prices is the balance between supply and demand. When demand outpaces supply, prices tend to rise, whereas an oversupply can lead to lower prices. Helixtap’s advanced analytics can help businesses anticipate shifts in supply and demand, enabling them to make strategic decisions about sourcing, production, and sales.

2. Global Production

Rubber production is heavily concentrated in Southeast Asia, with countries like Thailand, Indonesia, Vietnam, and Malaysia being the leading producers. Any changes in the production levels in these countries can have a direct impact on rubber prices. Helixtap data closely monitors global production trends, providing valuable insights into the factors that may affect production levels, such as weather conditions, political situations, and economic policies.

3. Weather Conditions

The rubber tree, Hevea brasiliensis, is highly sensitive to weather conditions, which can significantly impact rubber production. For instance, excessive rain can hinder latex tapping, while droughts can lead to lower latex yields. Helixtap’s machine learning capabilities allow us to analyze and predict weather patterns, helping businesses prepare for potential disruptions in rubber supply.

4. Economic Policies

Government policies and regulations can also play a crucial role in shaping rubber prices. For example, export restrictions or subsidies can affect the global supply and demand balance, leading to fluctuations in prices. Helixtap’s data-driven insights keep businesses informed about relevant policy changes and their potential impact on the rubber market.

5. Currency Exchange Rates

As an internationally traded commodity, rubber prices are also influenced by fluctuations in currency exchange rates. A stronger US dollar can make rubber more expensive for importers, leading to a decline in demand and lower prices. On the other hand, a weaker dollar can boost demand and push prices higher. Helixtap’s analytics can help businesses anticipate and respond to changes in currency exchange rates, allowing them to mitigate risks and seize opportunities.

By leveraging Helixtap’s comprehensive data and advanced analytics, tire manufacturers, automotive companies, and trading firms can gain a deeper understanding of the factors that drive rubber prices. Our machine learning capabilities allow us to process vast amounts of data and generate accurate predictions, helping businesses make informed decisions and stay ahead of the competition.

In conclusion, the rubber market is influenced by various factors that can cause prices to fluctuate. By partnering with Helixtap, businesses can access valuable insights and analytics that will enable them to navigate the complexities of the rubber market with confidence. With our data-driven approach, companies can not only adapt to changing market conditions but also identify opportunities for growth and innovation.