50% drop in premiums for LTC, changing dynamics increases anticipation

The annual long-term contract (LTC) premium for rubber is expected to see a 50% drop amid the bearish global market cues. Meanwhile, due to the volatility of spot markets, buyers are showing some preference for non-traditional sources. However, whether there will be a reduction or increase in contract volume is yet to be seen, especially with prices at a 2-years low.

The current physical rubber prices are lower than the 7-year average, primarily driven by the bear market. According to Helixtap data, the prices have dropped 27%-31% across the board since January 2022. This downward bias in prices, coupled with the weakness in market fundamentals, has resulted in a drop in the premium for the LTC negotiations.

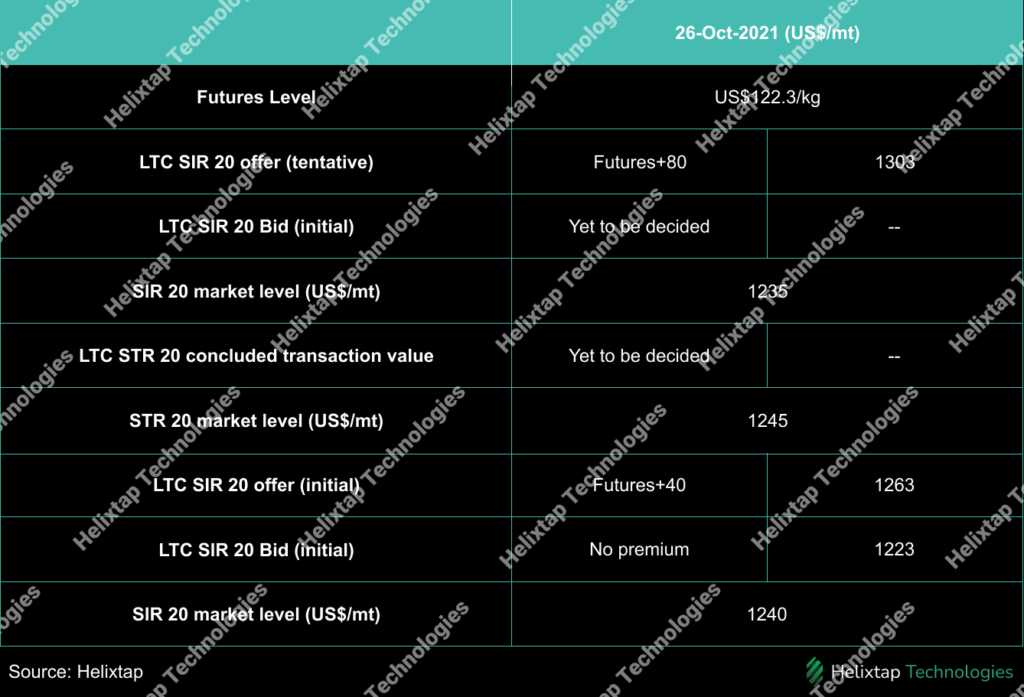

The market is expecting the settlement value for SIR 20 LTC would be at a premium of US$80/mt on SGX SICOM TSR20 Futures (US$ 122.3 /kg, on October 26, 2022) which translates to US$1303/mt, while the physical price is at US$1235/mt on FOB basis.