Higher commodity prices fanned global inflation following the surge in demand post easing of Covid-19 has jeopardized the rubber market as it continued to confront supply bottlenecks and rising energy prices.

It is a tight rope walk for the rubber industry now as, on the one hand, they are struggling with the volatile demand as the key rubber-producing nations deal with inconsistent production. But, on the other hand, the concern of inflation is prompting the banks to raise interest rates coupled with supply chain disruption, which would limit the cash flow in the market is likely to weigh on the producer’s margin. Thus, all these factors would impact the market confidence adding pressure on the rubber prices.

However, a lot depends on how quickly the automotive sector returns to pre-COVID levels, while risks related to logistical issues persist on the supply side.

How it started

Sooner than expected rebound in consumer demand chocked the supply side, which was already struggling with global transport network disruption hindered by government restrictions due to pandemic.

Moreover, the freight costs impacted by higher oil prices have pushed up the landed cost of rubber, which elevated the cost of production of tires. Thus, this growing pile of economic concerns resulted in the inflation surge.

There are other substantial risks that threaten the demand-supply balance, including the uneven COVID-19 recovery, the threat of more outbreaks, currency fluctuation, and environmental policies.

More broadly, heavy rains in the key rubber-producing countries on changing weather patterns have highlighted the risk of consistent rubber production, thus affecting supplies.

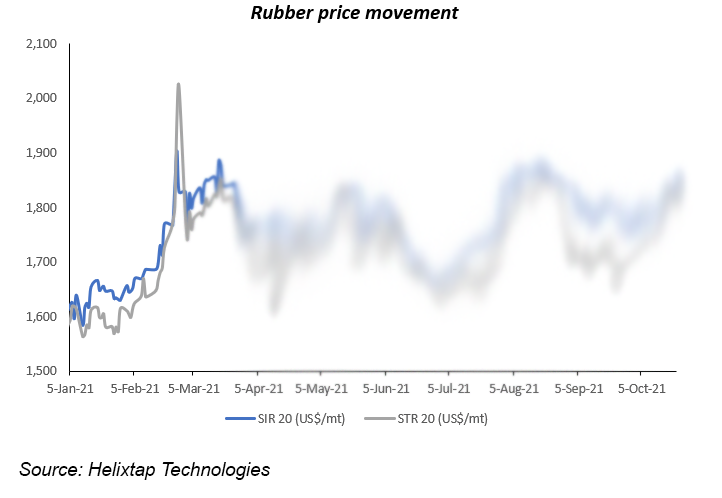

Prices movement

After surging earlier in the year in March, natural rubber prices retreated in Q3 2021 Q3, down by 2% for Standard Indonesian Rubber (STR) 20, while Standard Thailand Rubber (STR) 20 largely unchanged from the previous quarter. However, SIR 20 prices were 45% higher on a year-on-year basis, and STR 20 saw a massive 67% hike.

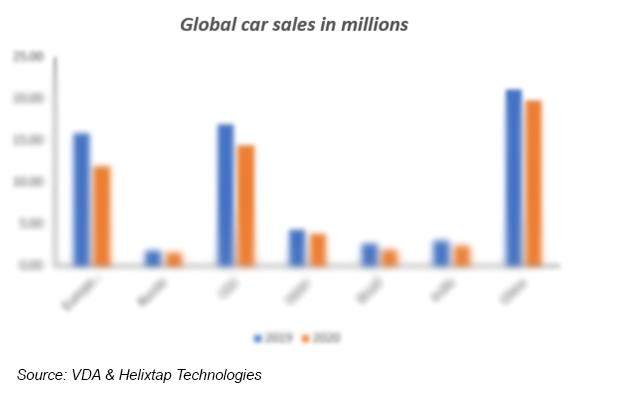

After a remarkable recovery in demand in early 2021, the lower vehicle sales owing to a semiconductor shortage thwarted the revival of the natural rubber market in recent months.

According to industry reports, Toyota had to temporarily stop several of its auto assembly lines due to the disruption to supply chains in Southeast Asian manufacturing hubs. Around 60% of the carmakers in Europe have been affected by the supply shortage.

READ MORE

- Helixtap China report: Weakness prevails Amid Oversupply, Trade Tensions, Soft Demand

- Tire giants redraw India playbooks; Indian firms rework overseas

- Chinese tire giants accelerate global expansion amid trade barriers

- Indonesia defies headwinds to post robust rubber exports in early 2025

- Tariff war, weather hit Thai rubber exports hard in April

- Exports nosedive, but Sri Lanka’s rubber industry aims high

- Wintering, labour shifts cripple Malaysian rubber output in April

- Indian Natural Rubber production marginally improves, consumption down