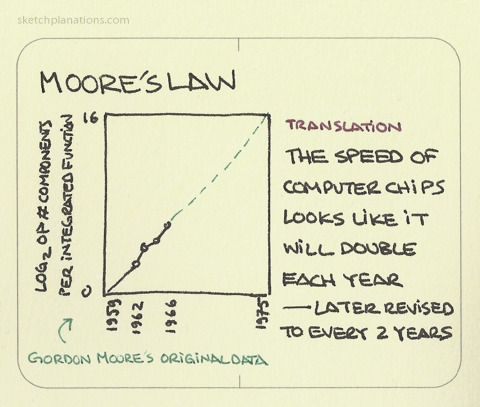

Give Commodities some Moore’s Law:

According to Intel co-founder Gordon Moore, he observed in 1965 that transistors were shrinking so fast that every year twice as many could fit onto a chip, and in 1975 adjusted the pace to a doubling every two years.

This has seen tangible benefits in various sectors ranging from personal communication devices, transport, banking and retail. It would be easy to overlook the raw material industry as it is unobtrusive (and probably not as visible or on the radar of the millennials).

This simple rule would have important implications in the technology revolution in the commodities industry and shaping its future.

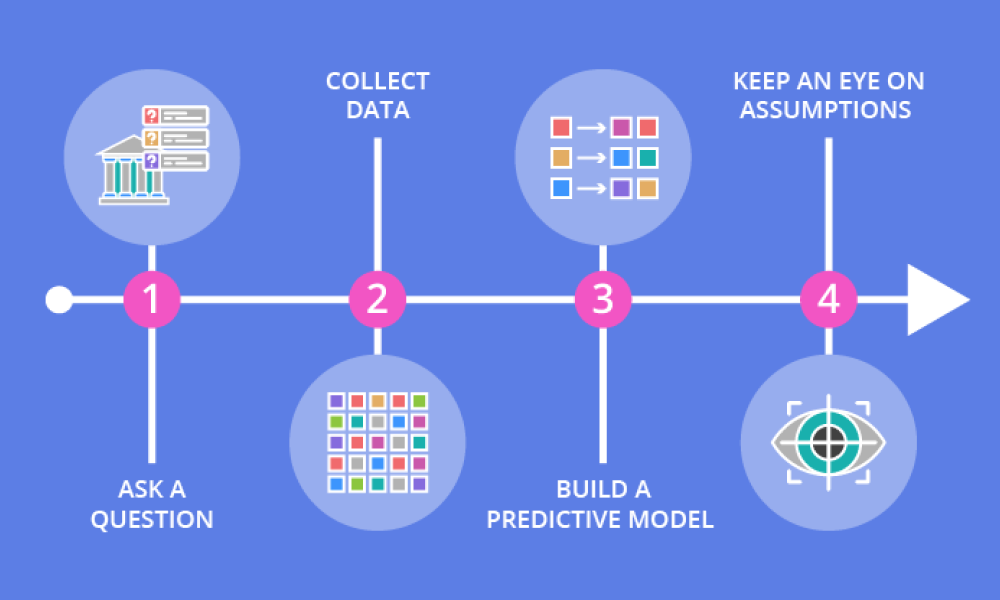

1. AI and Predictive Analytics

Picture a trading floor in 2025: A trader (human-assisted or algorithm) will be able to execute a trade physical coal to a steel mill.

First, the trader will scan and collate interest (demand), and find out the amount of stock (supply) on hand. Based on the customer’s requirements (past and predicted), the trader will put forward the offer. Once it is accepted by the customer, it will be confirmed and recorded automatically.

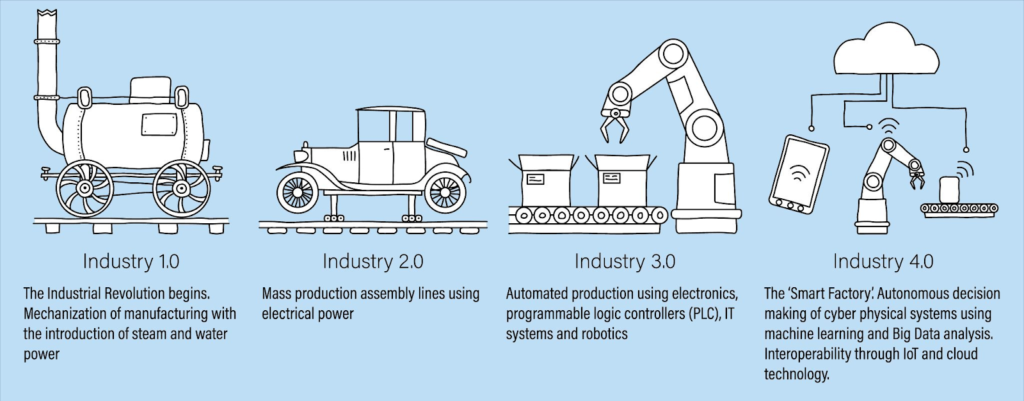

2. Super Just-In-Time

If the vision of Industry 4.0 is to be realized, most enterprise processes including the supply chain must be digitized.

For example, an Australian iron ore manufacturer could:

- Get updated demand on customer requests or demand scenario

- Load cargoes automatically using self-driving trucks and vehicles

- Send out vessels to reach destination ports in China (taking into account voyage time)

- Or, organize floating warehouses which enable adjustments and real-time reactions as conditions or requests change

- Process documentation easily online

- Monitor and reward firm and employees performance and sales records accurately

3. Smart Contracts

Not necessarily… [gasp!] on the Blockchain

Smart contracts help you exchange money, property, shares, or anything of value in a transparent, conflict-free way while avoiding the services of a middleman. Coined by Nick Szabo in 1994, way before any “blockchain revolution” he was ahead of his time.

Imagine this scenario (same iron ore manufacturer):

- Once the order for a Capesize vessel loading in December 2018 has been confirmed, a contract between the producer and consumer will be issued automatically

- Contracts would be signed and recorded in the cloud for all relevant parties to view and/or act on

- Reminders would be issued nearer to the date and vessels will be booked and vetted

- Loading commences and payment is released by the buyer

- The vessel is tracked all the way to discharge port

4. Personalization on Scale + Consumer Empowerment

The new commodities landscape should utilize technology, and focus on the customer.

As technology improves, each party on the supply chain would need to demonstrate value.

For example, take a household (for electricity):

- They have solar panels installed on their roofs and a meter with their preference input (split of type of energy based on their budget or based on the season for instance).

- When they are close to the limit or require more energy for heating or air conditioning, a demand signal is sent through to a procurement system.

- This then triggers energy suppliers (could range from solar, wind, coal providers) to fill this end-user order.

- On the flipside, houses with surplus energy, could also become sellers and offer their credits of electricity to another house at a certain price.

- Over time, each household has its own consumption patterns which can be analyzed based on district etc, but rich consumer data will allow for personalization on a scale not yet seen before.

5. Shared Ownership

The average cost per mile of UberX is probably around $1.50 (€0.84/km). It already costs more than that to own a car in some places.

In the same way, firms are aiming for leaner teams (read: cost-saving) and incorporating SaaS functions in their day to day as it seems much cheaper and more efficient for them to do so. For example Xero for accounting, and Stripe for payments and billing.

This would probably mean commodities firms could use services such as operations and risk management software to save a huge chunk of cost and improve profit margins.

Bottom Line:

In the (very near) future, the way we think about everyday products that commodities supply and power could change. Instead of viewing them as products, each of these items become platforms in which various services can be offered and rendered.

Published on Medium

READ MORE

- Low-risk, high stakes: India sharpens rubber EUDR compliance focus

- Helixtap China report: Weakness prevails Amid Oversupply, Trade Tensions, Soft Demand

- Tire giants redraw India playbooks; Indian firms rework overseas

- Chinese tire giants accelerate global expansion amid trade barriers

- Indonesia defies headwinds to post robust rubber exports in early 2025

- Tariff war, weather hit Thai rubber exports hard in April

- Exports nosedive, but Sri Lanka’s rubber industry aims high

- Wintering, labour shifts cripple Malaysian rubber output in April