Technology in commodities supply chain — why it is essential.

Commodities are the fundamental building blocks of all that is around us; everything that you use and come in to contact with originated from raw material. From smartphones, electricity, ships, tyres, automobiles. Commodities have played a large role in shaping global political and trade history.

Commodity trading has roots in Sumerian civilization between 4,500 BC and 4,000 BC. Clay tokens — representing the number of commodities, say the number of goats — were sealed in a clay vessel to represent a promise to deliver the goods. Later, tablets replaced the tokens. Complex gold and silver markets evolved in the classical civilisations.

However, the processes and the way of interactions in this age-old industry has been just that, age-old and thriving on opacity. The disconnect is that the Internet has brought about the democratization of information and these traders and middlemen have to innovate and adapt to survive. Furthermore, digitization is changing the way businesses operate and the world we live in today. Why should this exclude our raw material trade considering industry participants spend at least 10 hours a day at work?

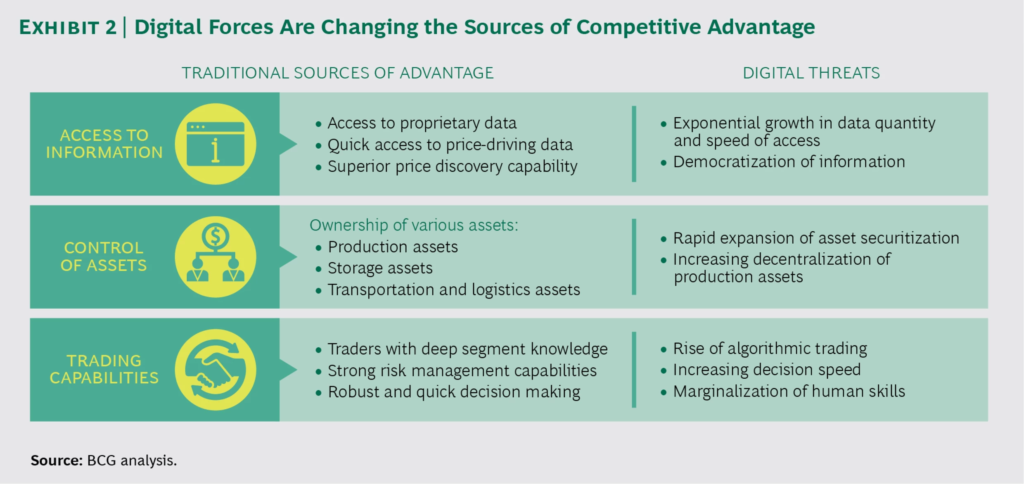

According to BCG’s white paper, “this [digitization] trend is transforming the commodity-trading value chain and redefining sources of competitive advantage, redistributing as much as $70 billion in trading value in the process.”

What was a source of competitive advantage in the past is evolving. In this new economy, the biggest risk facing incumbents and existing players in the industry is that of inaction. For example, Ant Financial is now one of the top 10 banks and went from a $50bn valuation 2.5 years ago, to $150bn last month.

While each of the industry participants is leading experts in finding out and exploiting inefficiencies in the market, we think its high time that producers and end-users leverage off technology to keep more of the margin. The timing has never been more ideal for technology to make its way into this conversation.

Published on Medium

READ MORE

- Strong monsoon over key rubber-producing nations

- Supply squeeze drives up Indian latex prices, sheet range-bound

- Malaysia’s rubber sector in flux as Q1 2025 draws to a close

- Indian SR prices downward, but domestic demand upbeat

- Biden era tire emission rule in bin; USTMA welcomes it

- Indian tire majors launch ‘iSPEED’ to empower 2 lakh rubber smallholders

- Tariffs add to uncertainty in global tire markets

- Thai rubber production to grow in 2025, but rains, prices can spoil party